Welcome to Company Inc.

Vestibulum sit amet nisi eleifend, laoreet erat in, ornare neque. Donec eu est in quam luctus sagittis. Nulla facilisi. Proin faucibus nec nulla vitae ullamcorper.

Sed ornare nunc ac elit pretium, nec blandit sem cursus. Maecenas in nibh id dolor molestie tempus. Nam et urna lorem. Donec eu est in quam luctus sagittis.

Professional services

Reliable support

Solid contract

–

Webinars organized by Candoris are interactive, often in Q&A format, concrete and to the point.

Upcoming Webinars:

July 15th, 03:00 – 04:00 PM CEST VanEck Emerging Market Equity Quarterly update with PM David Semple

Register: VanEck Emerging Market Equity Quarterly Update

August 13, 03:00 – 04:00 PM CEST VanEck Emerging Market Equity Quarterly update with PM David Semple

Register: VanEck Unconstrained Emerging Market Debt Quarterly Update

August 18, 10:00 – 11:00 AM CEST Eleva Leaders Small & Midcap European Equities (To be confirmed)

Register: Eleva Leaders European Small & Mid Cap Quarterly Update

August 25, 03:00 – 04:00 PM CEST DSM Global, US Large Cap & Emerging Market Growth Equities with CIO Daniel Strickberger

Register: DSM Growth Strategies Quarterly Update

September 2, 04:00 – 04:25 PM CEST Pacific Asset Management US Senior Loans

Register: PAM US Senior Loan Quarterly Update

September 2, 04:30 – 05:00 PM CEST Pacific Asset Management US Investment Grade ESG Strategy

Register: PAM US Investment Grade ESG

September 10, 04:00 – 05:00 PM CEST SiM US High Yield update with PM’s Gary Pokrzywinski and Ryan Larson

Register: SiM US High Yield Quarterly Update

September 16, 03:00 – 04:00 PM CEST Orchard US Small Cap Value (To be confirmed)

Register: Orchard US Small Cap Value Quarterly Update

September 23, 03:00 – 04:00 PM CEST Coho ESG US Large Cap Equities

Coho ESG US Large Cap Equities

- Portfolio of companies that provide downside protection during difficult periods and competitive upside participation

- 1 team, 1 philosophy, 1 investment approach!

- Concentrated, high active share, very low turnover

- Employee owned, investing own private wealth in strategy

Why Coho for US Large Cap Equities?

- 23-year track record of managing US Large Cap Value Equities with only 80% of benchmark volatility.

- True diversifier in your portfolio due to contrarian performance pattern (outperformance in down-markets).

- One of few US Value oriented managers with ESG fully integrated in investment process.

Who is Coho Partners?

Coho Partners, founded in 1999, is an independent employee owned boutique manager located close to Philadelphia. Coho manages almost 10 billion USD, mostly institutional assets.

Coho Partners Commitment to ESG

The integration of ESG considerations into the investment process is a natural extension of the investment approach. The investible universe defined by Coho, consists of companies explicitly chosen because of their long history of stable business models, solid growth, excellent management teams and shareholder friendly practices. These high quality companies tend to have high levels of awareness and engagement in sustainable practices and good governance making the proprietary ESG evaluation methodology complementary to the core philosophy and process.

Principal Investment philosophy

Coho’s investment philosophy is based on the premise that the most effective way to create and sustain wealth in the equity markets is to achieve an asymmetric pattern of returns over time, where the portfolio demonstrates a down market capture considerably less than its up-market capture. This combination should ultimately provide an opportunity for better than market performance over an economic cycle, with less than market risk.

Orchard US Small Cap Value Equities

- Portfolio of companies that trade at a significant discount and have one or multiple catalyst to unleash their intrinsic value.

- 1 team, 1 philosophy, 1 investment approach!

- Concentrated, high active share.

- Employee owned, investing own private wealth in strategy.

Why US Small Cap Value Equities?

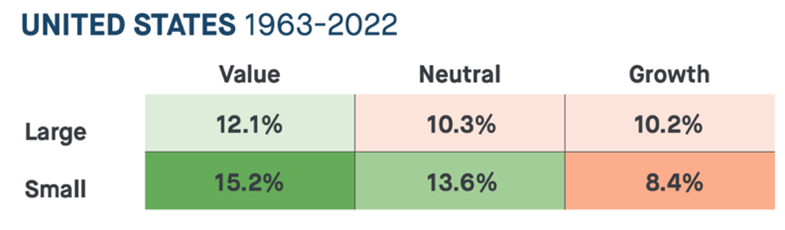

Source: Ken French Data Library

Why Orchard for US Small Cap Value Equities?

- Strategy with 22 year track record in US Small Cap Value investing.

- Proprietary research and a disciplined process.

- ESG fully integrated in investment process.

- UCITS fund with one of the largest AUMs in Small Cap Value.

Who is Orchard Capital Management?

Orchard is an independent employee-owned boutique based in Chicago with a track record dating back to 2001. The investment team has deep investment and industry experience.

Principal Investment philosophy

Orchard’s Opportunistic Small Cap Strategies builds upon a core philosophy:

''Proprietary knowledge, not excess risk, drives excess returns"

Orchard uses proprietary knowledge to create the best possible estimate of intrinsic value and strives to generate excess returns by investing at what they consider a significant discount to intrinsic value.

Once Orchard has identified sources of value or opportunities for value creation, they select investments with one or more catalysts that should lead to value realization and will engage management & shareholders for constructive change.