Who are we?

- We select concentrated investment strategies with a high active share and long-term proven track record managed by employee-owned boutiques.

- We set up UCITS funds on our own platform, raise seed capital and facilitate Pan European marketing.

- We have 51 investors that invested a total of USD 2.8 Billion in UCITS funds and separate accounts.

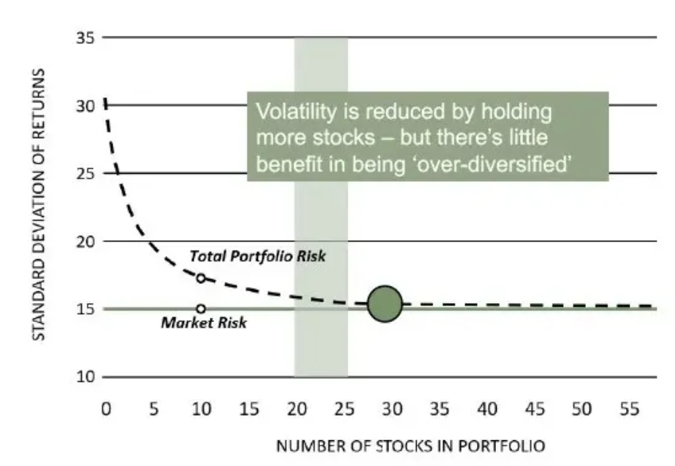

Why concentrated?

Research indicates that concentrated strategies have the best performance. Beyond 30 stocks in portfolio there are hardly any diversification benefits.

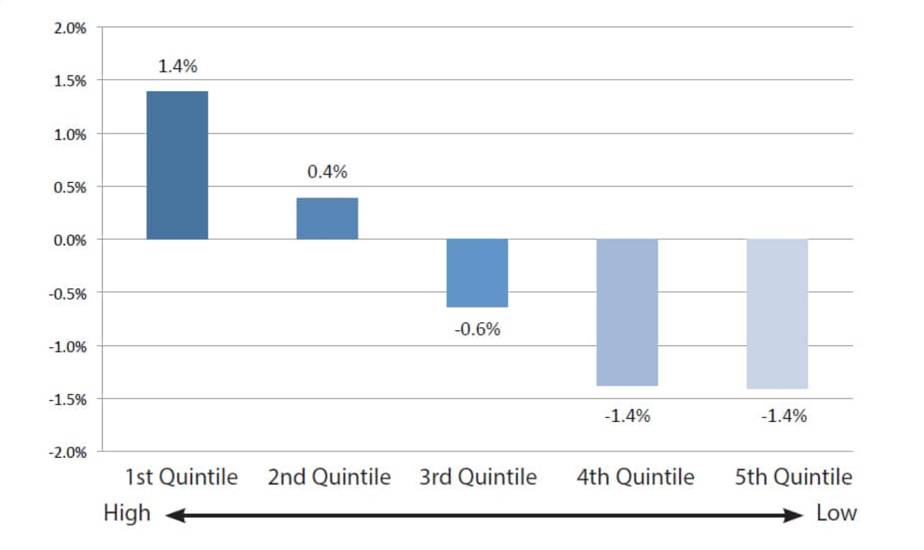

Why a high active share?

Research indicates that high active share strategies have the best performance.

Benchmark-Adjusted Returns for Active Share Quintiles

After fees and transaction costs for all-equity mutual funds in 1990-2003. Source: "How Active is Your Fund Manager? A New Measure That Predicts Performance," by Martijn Cremers and Antti Petajisto of the International Center for Finance at the Yale School of Management, March 2009.

Why employee owned?

Research indicates that Asset Managers with the strongest long-term gross returns tend to have a high level of employee ownership.

“One factor stood out as having the most explanatory power behind five-year returns: Employee ownership” Based on trailing five-year returns of 789 asset managers between 1997 and 2017, using data from eVestment.

Source: Institutional Investor

Other criteria we find important

- We have a strong preference for asset managers with focus; 1 team, 1 philosophy and 1 investment approach!

- We have a strong preference for asset managers with low turnover in portfolio holdings and investment team.

Where do we stand

Investment Strategies

Investment Strategies

Candoris - Managers

Orchard - Chicago, IL, United States

Next Century Growth Investors - Minneapolis, MN, United States

Coho Partners - Philadelphia, PA, United States

DSM Capital Partners – Palm Beach Gardens, FL, United States

Letko Brosseau Global Investment Management - Montreal, Quebec, Canada

DSM Capital Partners – Palm Beach Gardens, FL, United States

Strategic Income Management – Seattle, WA, United States

VanEck – New York, NY, United States

Agenda

Online Updates:

We regularly organise online updates with the Portfolio Managers of the strategies, to view the full agenda and subscribe for the webinars, please click the link below:

Roadshows:

We organise roadshows on an annual basis with the Portfolio Managers of the strategies, to view the upcoming agenda and indicate your interest for a meeting, please click the link below:

Our Team